The regulatory framework for cryptocurrency-related activities in Andorra.

Cryptocurrencies remain largely unknown in most countries. Bitcoin has exploded since its launch, and the banking sector has been watching it closely, and has also imposed strict regulations.

The banking system has been strict regarding the use of Bitcoin as a method for a money laundering operation, however Andorra has been betting for a year now on implementing Blockchain technology and that is why last January 27, 2021 the draft Law on digital assets through the use of cryptography and blockchain technology entered into procedure.

To this draft law of digital assets 38 amendments have already been made and currently it has been approved after its 14th extension, here you can find the full text.

Law regulating Blockchain technology

Andorra has already enacted a new law regulating cryptocurrencies. This activity is currently not legal and, therefore, the Principality is likely to be one of the first countries to be legally governed. In a draft law, Andorra has pledged its commitment to cryptocurrency and blockchain. Cryptocurrencies are currently being developed and the wider cryptocurrency community is looking to create a cryptocurrency hub.

This new law will move forward in a modest way, as quite a few points have been modified from the initial text, but it is nevertheless positive that this sector is finally being regulated in Andorra.

One of the main concerns of the Andorran legislature is that crypto could be used for money laundering and that is why this law is taking longer than usual to be approved. However, Andorra’s desire is to regulate 100% this sector and thus attract more projects and foreign investment based on cryptocurrencies in Andorra.

Despite the fact that the banking sector does not like this law, as they find in the regulation of this sector a direct competition, this law is following its course and it is a matter of months before it is fully approved.

What’s new in the Regulation

ICOs and blockchain technology startups will have new regulations by 2022/23. The Andorran Parliament is expected to pass legislation on the matter before the end of 2022 or early 2023.

This law raises issues such as for example business projects could access different sources of capital to move forward, beyond the traditional ones (especially banking). On the other hand, private individuals, both at home and abroad, would also find it easier to invest directly in some initiatives. However, pressure from the sector has led to a postponement of this regulation.

In the end, a two-phase implementation was chosen.

The first, approved on June 30, 2022 by the General Council of Andorra, will open the door to different activities with these digital assets. This is the case, for example, of companies or public entities that want to create a type of virtual wallets from which to pay for services. For example, a ski resort in which the user uses digital money. A good part of these activities will also have to be supervised by the AFA.

What remains «frozen» is the whole financing part. The reason, according to sources, is that it would require a very important supervision by the AFA (Andorran Financial Authority) that, right now, both for resources and experience, it is not prepared to assume. For this reason, it has been agreed that the Government, with the collaboration of the entity, will later present a legislative project that will then regulate this whole area.

The pact transfers «the tempos» to the supervisor, which will have to be provided with human and technical resources to be able to assume the new functions that the future law will grant it. Even so, a timetable has been put on the table. Fifteen months are given because this text on «issues of digital assets that can be considered financial instruments» will be drafted. Therefore, already in view of the next legislature.

Incorporate a Crypto-Company in Andorra

Are you an investor in cryptos? Do you want to establish your company directly in Andorra?

In Andorra Services we already have several projects based on this sector and we can help you to establish yourself in the country quickly.

Andorran residents can invest in digital currencies such as bitcoin and plan income tax at a relatively low European rate. But what do you need? Simply provide your source of funds as needed for a business operation in Principality.

Andorran banks are currently requesting the origin of funds from our clients to be able to operate directly with a bank account in Andorra.

Currently, banks such as Mora Banc, accept direct transfers from Bitstamp and Kraken (note this, because it is very valuable information).

Cryptocurrency professionals residing in Andorra

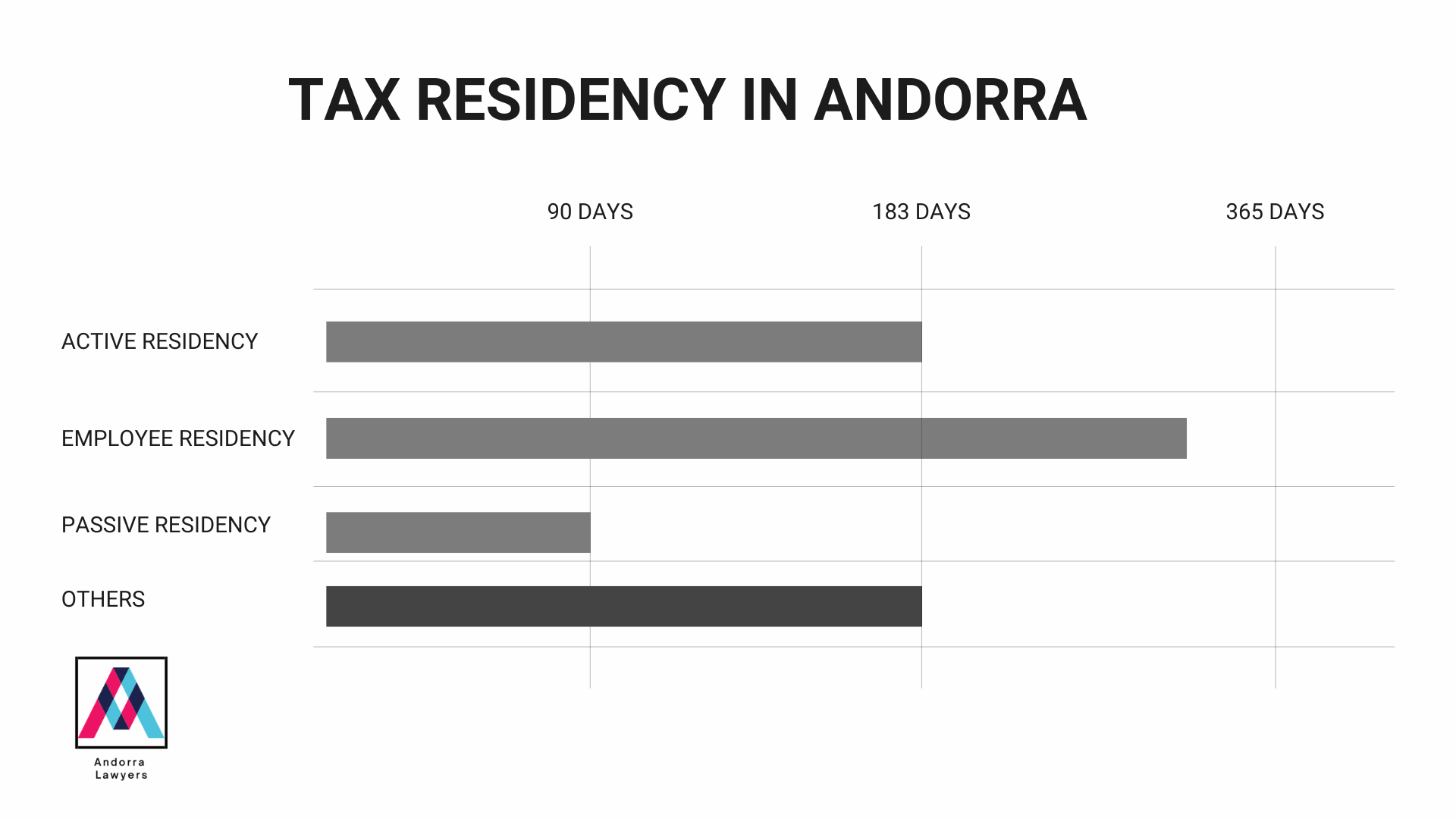

More and more professionals choose to move their residence to Andorra. This is because in this small country that despite being in Europe is not part of the European Union and that makes them have a very interesting tax system for cryptoinvestors. In fact, for crypto-investors and for the rest of investors, here is a graphic example of the tax savings in Andorra:

Cryptocurrency-exploitation / mining in Andorra

Andorra has the capacity to provide adequate infrastructure for mining activities. Official Eurostat figures show that Andorra has the lowest electricity market in Europe. The cost in the small principality is 0.134 euros per kWh, while in Europe the average cost is around 0.5 euros per kWh.

In addition, Andorra has extremely stable electrical installations and outages and interruptions are rare compared to Spain in particular. Industrial property can be rented and a server based on suitable conditions can be built.

The advantages of cryptocurrency trading or cryptocurrency mining in Andorra

Andorra clearly has several advantages in blockchain technology projects involving entrepreneurs and professionals residing in Andorra. Technology companies have been created to attract more people because many factors are involved.

Security, environment and taxation make Andorra a very attractive place for cryptocurrency. Find more details about Andorra’s tax advantages here.

However, cryptocurrency investments in Andorra should not be confused with the conventional factors that make an economy competitive.

Taxation Bitcoin and cryptocurrencies Andorra

Initially bitcoins appeared as a stealthily disruptive technology in 2009.

Currently anyone can operate in this sector, with more or less knowledge. That is why you have to take into account what taxes are due when you have tax residency in Andorra and you have profits either personal or from your crypto companies.

Here we explain how and when exactly you have to declare your profits and in this other article we show you the taxation by country of the profits derived from crypto.

Taxes Cryptocurrencies | Andorra Bitcoin

If you want to know more about Bitcoin or cryptocurrency, Andorra Services can help you. In Andorra there is currently a large community of users specialized in Bitcoin and other cryptographic currencies.

How are cryptocurrencies taxed in Andorra?

Taxes for the sale of cryptocurrencies are taxable at the maximum 10% of personal income tax in Andorra.

This calculation is the profit.

In the purchase and/or sale of cryptocurrencies, a buyer or seller is entitled to gain or lose from the purchase or sale of a coin. The returns offset losses and gains from the entire transaction, resulting in a net profit of 10% with a tax base of 10%. Optional costs are included for transactions.

How to become a resident in Andorra as a cryptocurrency investor and trader?

Depending on your exact activity within the sector, we can recommend either self-employed residency or passive residency.

If you have any doubts about which type of residence may be more convenient for you, do not hesitate to contact us.